This primer is for Liberty Township residents who want a clearer picture of how property taxes work — and how they impact township revenue. This understanding is essential for evaluating issues like the fire levy currently on the ballot.

Key Points

- 1 mill = $35 per $100,000 of appraised market value.

- Ohio has three kinds of levies (inside, fixed sum, and fixed rate), each responding differently to growth and property values.

- The fire levy is a fixed rate levy — it increases with population growth, not with rising market values.

- Fire levy revenue does not keep up with inflation.

- Per capita revenue is a more meaningful comparison for fixed rate levies.

What Is Millage?

Property tax is expressed in mills — where 1 mill = $1 per $1,000 of taxable value. Ohio taxes property on 35% of market value, so:

1 mill = 0.35 x market value ÷ 1,000

This translates to:

$35 per $100,000 of market value for every mill.

Three Types of Property Tax Levies

Ohio law allows for three distinct levy types. Liberty Township collects revenue from all three.

1. Inside Levies

Sometimes called unvoted millage, these are not subject to voter approval. The state caps inside millage at 10 mills, divided among local government entities.

In Liberty Township:

- 0.9 mills go to general revenue

- 1.2 mills go to roads and bridges

Inside millage increases with property value — higher property values mean higher tax bills.

2. Fixed Sum Levies

These levies raise a set dollar amount, often used to repay bonds. As property values or population increase, millage decreases, since the target dollar amount is set in advance.

Liberty Township’s bond levy millage has declined over time due to:

- Increasing property values

- Debt refinancing at lower rates

3. Fixed Rate Levies

These are the trickiest. Most local levies, including Liberty Township’s fire levy, fall under this category.

The millage is capped at the voted amount, but effective rates decline when property values rise. This is due to Ohio’s tax reduction factor, which ensures the township doesn’t collect more from existing property (known as “carryover property”) just because of higher appraisals.

Here’s how it works:

- When reappraisals increase overall property values (like the 35% increase in 2023), total revenue from existing properties doesn’t change.

- Individual tax bills may go up only if a property’s value increased more than the average.

- Increases from some properties are offset by decreases from others.

Most explanations skip this nuance, but it’s crucial for understanding why your tax bill may have changed without creating new revenue for the township.

Liberty Township Property Tax Revenue

Effective Millage Rates (2014–2024)

After the current fire levy began in 2014, you can see how the effective millage rate declined, especially after the 2023 reappraisal:

| General Revenue | Roads & Bridges | Bond | Fire [1] | |

| 2014 | 0.90 | 1.20 | 0.35 | 5.60 |

| 2015 | 0.90 | 1.20 | 0.35 | 5.48 |

| 2016 | 0.90 | 1.20 | 0.35 | 5.53 |

| 2017 | 0.90 | 1.20 | 0.33 | 5.38 |

| 2018 | 0.90 | 1.20 | 0.27 | 5.13 |

| 2019 | 0.90 | 1.20 | 0.24 | 5.00 |

| 2020 | 0.90 | 1.20 | 0.23 | 5.03 |

| 2021 | 0.90 | 1.20 | 0.19 | 4.63 |

| 2022 | 0.90 | 1.20 | 0.17 | 4.68 |

| 2023 | 0.90 | 1.20 | 0.17 | 4.61 |

| 2024 | 0.90 | 1.20 | 0.13 | 3.51 |

Table 1: Effective mill rates

[1] Tax reduction factors are computed separately by property class (e.g., commercial, residential). These amounts are blended across all classes and therefore will not match formally reported effective millage.

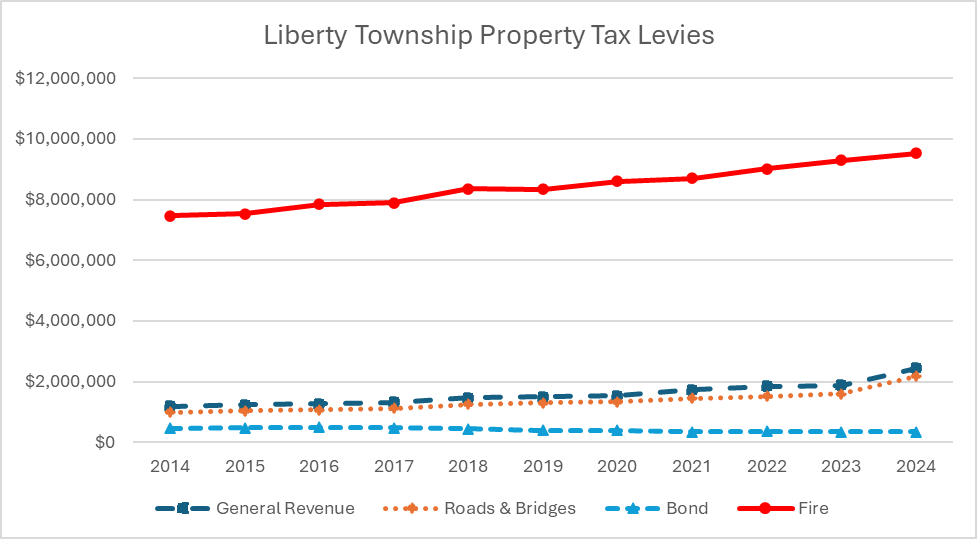

Total Revenue by Levy

The fire levy consistently produces the largest share of the township’s property tax revenue.

Revenue Normalized to 2014

To compare growth, we normalize each levy’s revenue to 1.0 in 2014. The general and road levies more than doubled. The fire levy grew by just under 30%, closely tracking population growth from 28,000 (2014) to 36,000 (2024).

Revenue from the fire levy increased with population but not with rising market values. And while inside millage rose significantly percentage-wise, the dollar increase was much smaller than that of the fire levy.

Conclusion

The fire levy does raise more money as the township grows — but not from inflation or rising property values. That’s by design. It was sufficient during periods of low inflation, but with higher costs now, revenue hasn’t kept pace.

That’s why it’s useful to compare per capita fire levy revenue — total levy income divided by population — over time and across townships. We’ll explore that in a future post.

Leave a reply to Liberty Township Fire Levy Tax Revenue (Per Capita) – Cultivated Resilience Cancel reply