As Liberty Township voters prepare to decide on the proposed fire levy, the financial health of our fire and EMS department has become a key topic of discussion. In this post, I’m going to break down what the current financial outlook looks like, how different funding scenarios produce different projected fund balance results, and why the proposed levy is so critical to maintaining a sustainable and responsive emergency service for our community.

Before we dive in, a quick note on assumptions. As an actuary, it’s in my nature to document every assumption I make. So, yes, I’m about to pull back the curtain and offer transparency on the numbers, just in case you were wondering about the magic behind the calculations. If you don’t like math or graphs, feel free to scroll to the end—I won’t take offense (promise). For the rest of you, let’s get into the data.

Sharp-eyed analysis may notice that there is some fluctuation to levy and other revenues. The township benefited from the “SAFER” grant that funded the costs of six new full-time hires from 2021 through 2023. While the fire department will continue to apply for grants, the projections do not count on them.

Here’s another disclosure. Bear with the fine print… The township has recently implemented programs to increase revenues that we DO expect to continue: EMS billing and a contract with the county to reimburse for EMS. Those are examples – and longer stories in themselves – of the township seeking responsible alternatives to delay the need for more property tax levy revenue. They have generated about $40 per capita the last two years; I continue them at that level through the projections. Reasonable variations to this assumption would not alter conclusions.

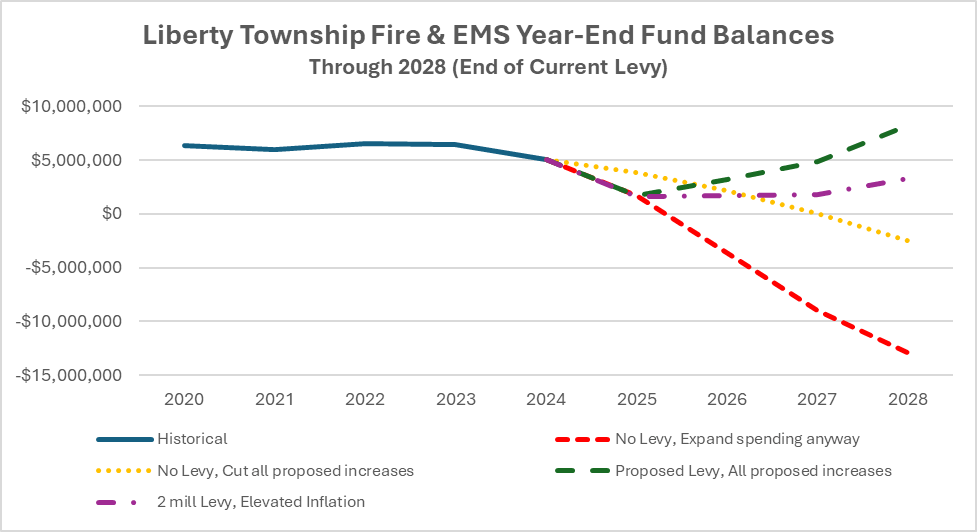

Historical Fund Balances

Before diving into projections, you may notice the historical fund balances for the fire department over the past few years in each of the charts. From 2020 through 2024, the year-end balances have remained stable at just over $5 million— a solid foundation. But as we approach 2025, that stability starts to erode under current funding conditions.

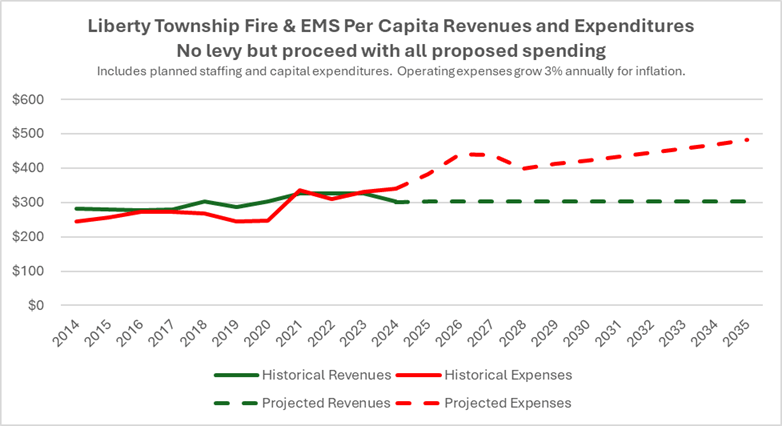

What Happens Without the Levy?

No additional levy for a protracted time plays out like a worst-case scenario. As shown in Figure 1, the fund balance quickly turns negative, reaching around negative $13 million by 2028. This would place the fire department in an unsustainable position, unable to meet operational or capital needs.

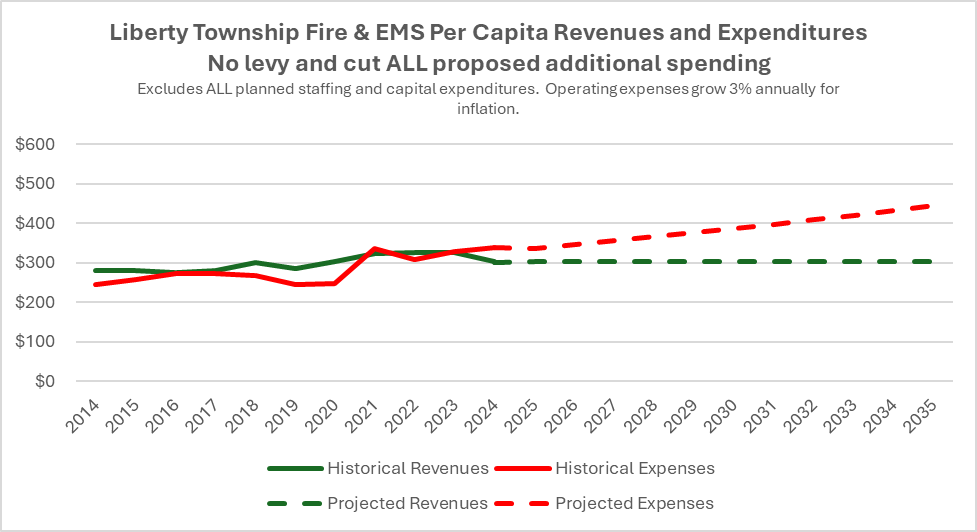

Cutting Planned Expenditures: A Temporary Fix

So, what if we decide to cut all proposed expenditures to save the department? Figure 2 shows the result. While trimming expenditures helps buy some time, the fund balance still drops into the negative by 2028. This scenario makes it clear that slashing costs won’t solve the long-term financial gap—we’d still be heading toward a cliff, just at a slower pace.

Never mind that not all cuts are feasible or that they can be done without risking additional operational costs, not to mention risks to critical services.

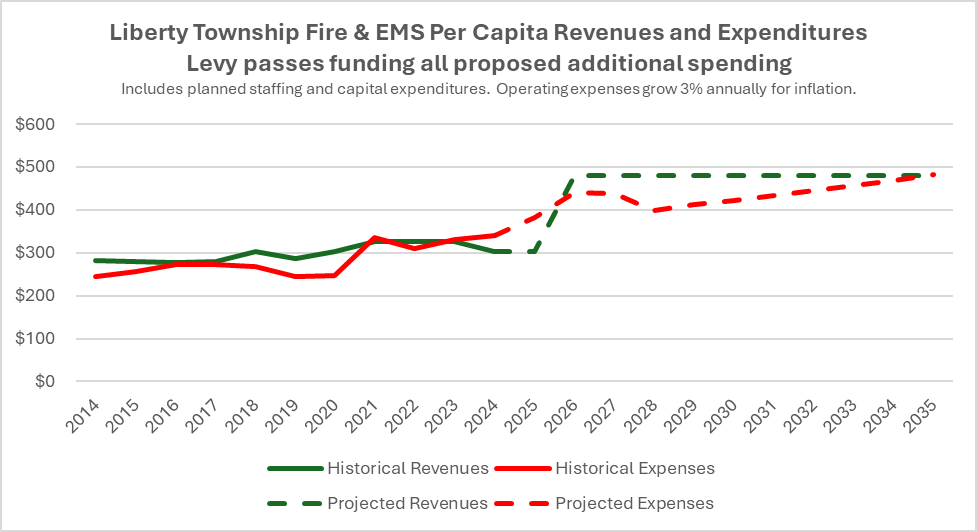

The Proposed Levy: A Path to Stability

This brings us to the proposed levy. With the levy in place, the fund balance grows back to the $5 million mark by 2027. This creates a buffer—giving the department both the flexibility to meet current needs and the capacity to respond to emergencies or unforeseen costs in the future. It’s the most sustainable option, ensuring the department can operate effectively for years to come.

A Hypothetical Reduced Levy: Living Paycheck to Paycheck

Finally, we explore the impact of an hypothetical 2-mill levy. Before proceeding, let’s acknowledge a couple of things:

- This choice is NOT on the ballot.

- I run a risk that voters could insist on this as a solution.

To the second bullet, perhaps officials or others very much wanting the levy to pass would rather keep it simple and not contemplate alternatives. I am sure that my readers are smart and know that the township could come back with a smaller ask. I feel like it’s my professional responsibility to show alternatives that are plausible, if not reasonable.

In Figure 4, the fund balance remains positive but never fully recovers to the $5 million target. It’s like living paycheck to paycheck—keeping the lights on but without enough room to breathe. This scenario is better than nothing, but it leaves the department in a precarious position, unable to fully plan for larger capital needs or unexpected crises. And again, this is NOT a choice on the ballot. We would have to continue with the uncertainty of definitely needing another ballot issue in November.

Projected Fund Balances

Having focused on per capita amounts up to now, I can project fund balances if I assume a given population growth. Since both revenues and incremental expense needs both grow with population, it’s not a key assumption. I assume 3% growth.

I will add an important side note here. I have pushed back when people argued, intending to support the first levy, that development increases the need for services. Yes, and they also increase revenue. It may not be a perfect offset. Not all property is the same. Per capita isn’t even the perfect measure. An example: the medical center expected to open in 2026. It will bring new revenue but also more significantly affect EMS needs. My gut is that it could be noticeable but not necessarily alter the conclusions of the current discussion. Any analysis beyond that would be speculation at this point.

Conclusion

Ultimately, the proposed levy provides a secure and sustainable path for Liberty Township Fire & EMS. While a hypothetical 2-mill levy (again, this is NOT a choice on the ballot) keeps the fund balance positive, it doesn’t offer the stability needed for long-term planning and growth. And without any levy, we risk more substantial shortfalls in just a few short years.

As voters, we must consider these different scenarios carefully. The proposed levy is more than just a financial question—it’s about ensuring the fire department can continue to serve our community effectively, without the constant threat of financial instability. And remember, as much as I’ve tried to balance all the assumptions in a way that makes sense, I’m an actuary—so I’ve probably overthought this.

Leave a comment